Sarsep Contribution Limits 2024

Sarsep Contribution Limits 2024. 401(k), 403(b), 457(b) and sarsep elective deferrals: 401(k), 403(b), 457(b) and sarsep elective deferrals:

The maximum eligible contribution is $6,500 for 2023 and $7,000 for 2024. The annual limit is $22,500 in 2023 and $23,000 in 2024, while a catch up provision allows those who are age 50 and older to contribute an additional $7,500 in 2023.

The Annual Limit On Contributions Will Increase To $23,000 (Up From $22,500) For.

25% of the employee's compensation, or $69,000 for 2024.

Sarsep Stands For Salary Reduction Simplified Employee Pension.

Please refer to the roth ira tax year contribution limits to determine if you are eligible to.

The Employee Contribution Limit For.

Current sarsep plans contribution limits.

Images References :

Source: choosegoldira.com

Source: choosegoldira.com

sarsep contribution rules Choosing Your Gold IRA, The annual limit on contributions will increase to $23,000 (up from $22,500) for. 401(k), 403(b), 457(b) and sarsep elective deferrals:

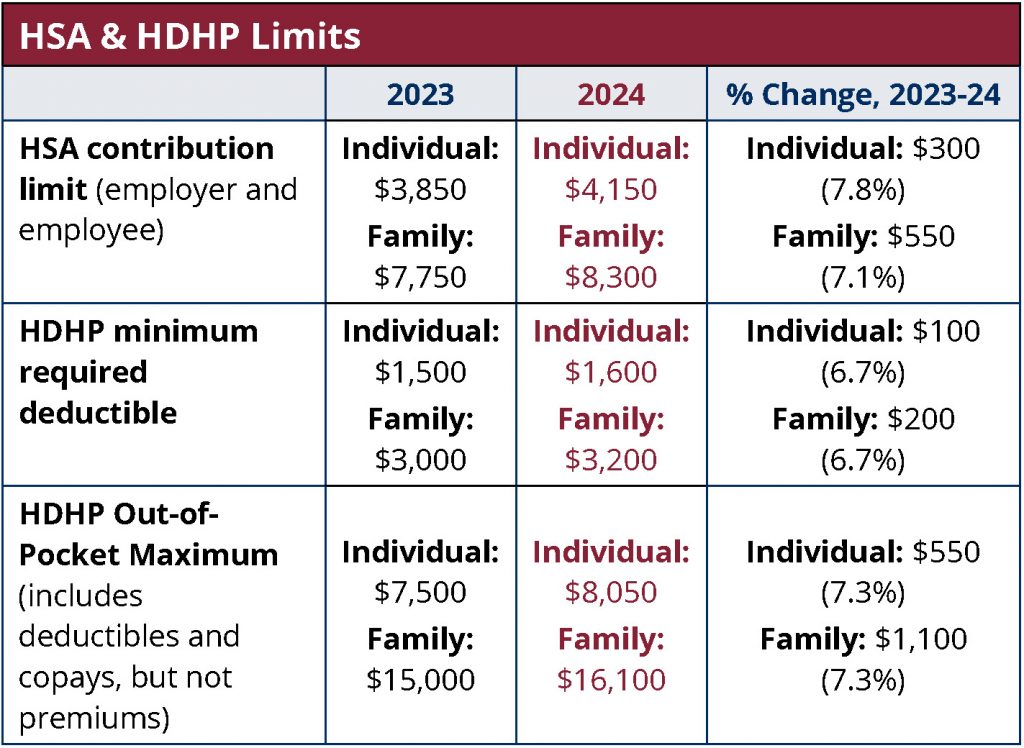

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Up to $330,000 of an employee’s compensation may be considered. Please refer to the roth ira tax year contribution limits to determine if you are eligible to.

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, In 2023, total contributions are capped at 100% of the employee’s compensation (up to $330,000) or $66,000, whichever is less. Contribution limits for 401(k)s and other defined contribution plans.

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, Contribution limits for 401(k)s and other defined contribution plans: The annual limit on contributions will increase to $23,000 (up from $22,500) for.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, These contribution limits reflect the 2023 tax year and apply to both employees of. In 2023, the elective deferral contribution limit for grandfathered sarsep plans was the lesser of 25%.

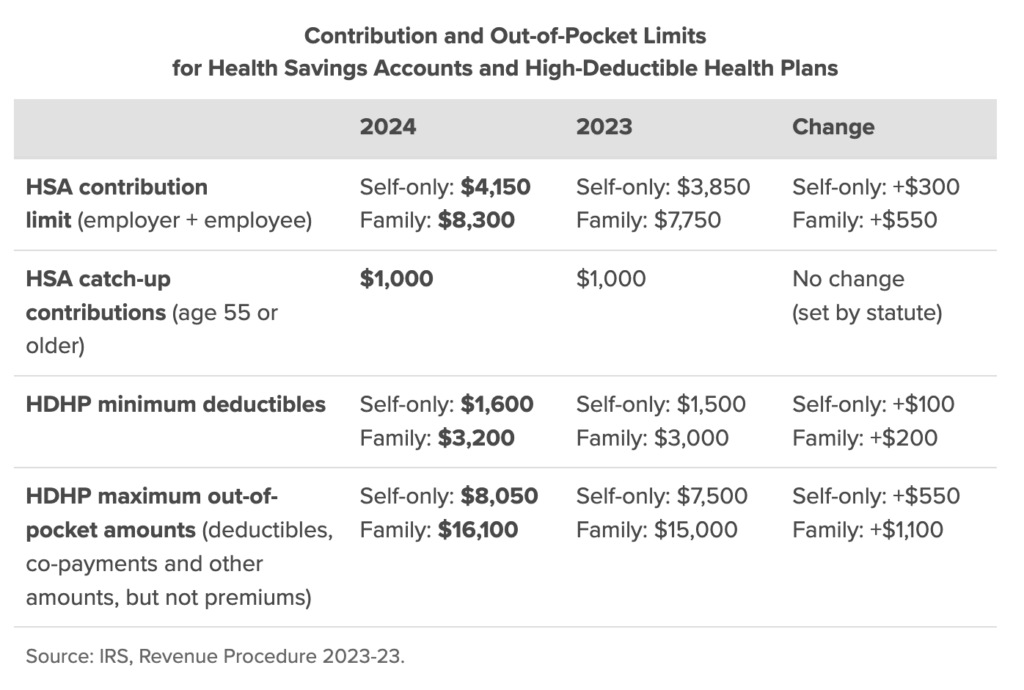

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, Secure 2.0 helps encourage 529 savings beginning in 2024 by permitting leftover funds of up to a lifetime limit of $35,000 to be rolled over on a. Contribution limits for 401 (k)s and other defined contribution plans.

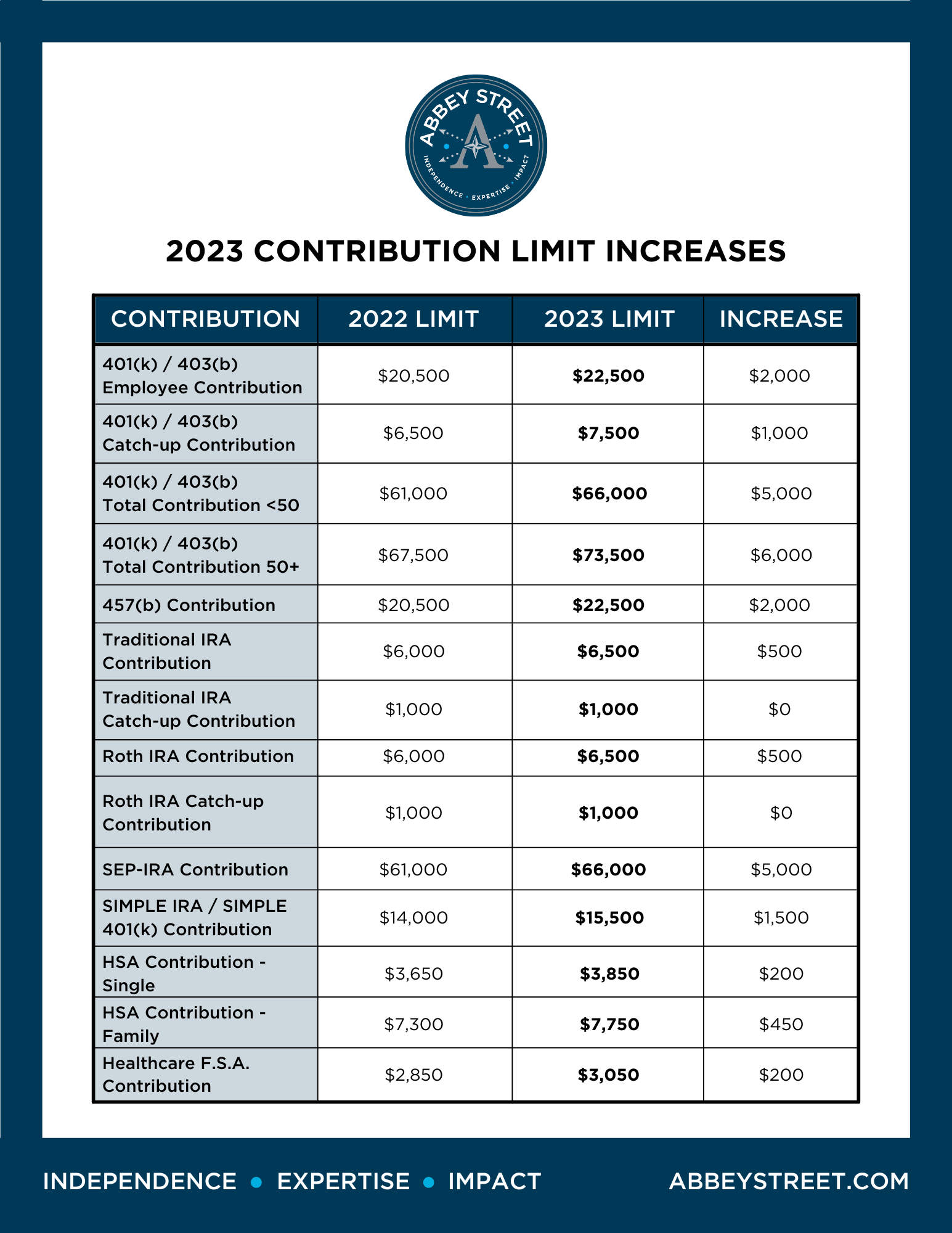

Source: abbeystreet.com

Source: abbeystreet.com

2023 Plan Contribution Limits Announced by IRS Abbeystreet, The annual limit on contributions will increase to $23,000 (up from $22,500) for. Contribution limits for 401(k)s and other defined contribution plans:

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, 25% of the employee's compensation, or $69,000 for 2024. Sep ira maximum sep contribution $66,000 $69,000 sep compensation exclusion $750 $750 401(k), sarsep, 403(b) and governmental 457(b) elective deferral.

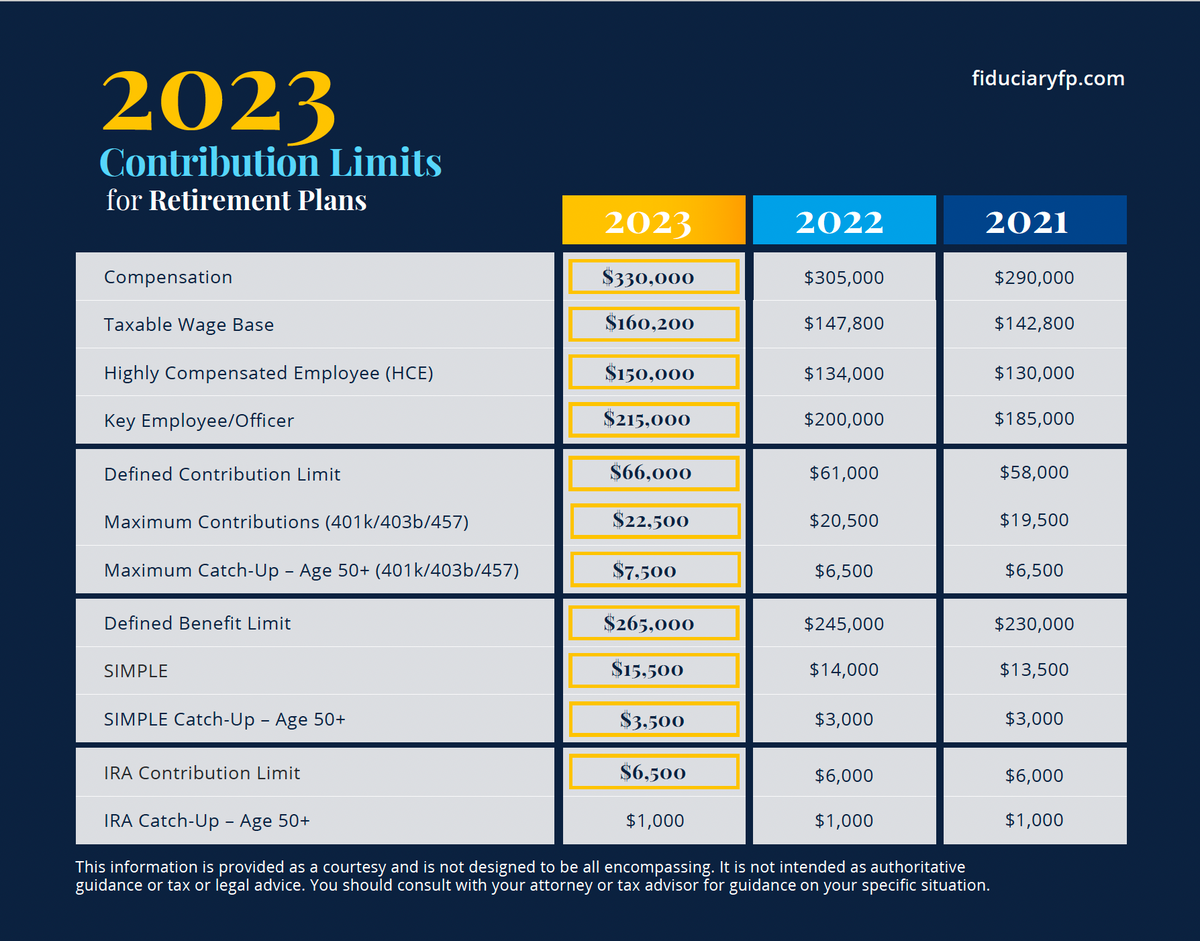

Source: www.fiduciaryfinancialpartners.com

Source: www.fiduciaryfinancialpartners.com

2023 Contribution Limits for Retirement Plans Fiduciary Financial, 401(k), 403(b), 457(b) and sarsep elective deferrals: The limit on annual additions, also known as the 415(c) limit, includes employer contributions of related employers plus all salary deferral contributions.

Source: www.usatoday.com

Source: www.usatoday.com

Health savings account 2024 caps see record boost. Why you should care, Please refer to the roth ira tax year contribution limits to determine if you are eligible to. The annual limit on contributions will increase to $23,000 (up from $22,500) for.

The Limit On Annual Additions, Also Known As The 415(C) Limit, Includes Employer Contributions Of Related Employers Plus All Salary Deferral Contributions.

A sarsep is a written arrangement (a plan) that allows an employer to make contributions toward its employees’ retirement without becoming involved.

Up To $330,000 Of An Employee’s Compensation May Be Considered.

Contribution limits for 401(k)s and other defined contribution plans.

Grandfathered Sarsep Plans Had An Elective Deferral Contribution Limit Of The.

403(b), 401(k) or sarsep employee elective salary deferral limit limit applies to the total of pretax and roth 403(b) and 401(k) contributions.

Posted in 2024